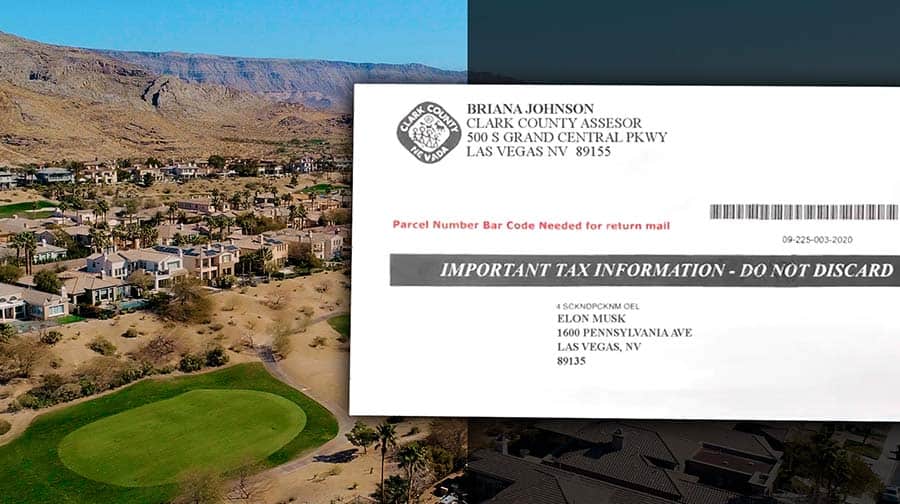

If you’re considering buying a home in Las Vegas, you should be aware of all the costs related to home ownership. One cost that is often overlooked is property tax. In Clark County, Nevada, property tax rates are among the lowest in the nation, but it’s still important to know when and how to pay your tax bill. The following FAQs answer key questions about property taxes for the Las Vegas Valley and Clark County.

When are property taxes due?

In Clark County, property tax bills are mailed annually in July, the beginning of the fiscal year (July 1st to June 30th). Taxes must be paid in advance for the fiscal year ahead, not the year that just ended. Payment is due on the 3rd Monday in August and can be completed online, by mail, or in person. If your bill exceeds $100, you can pay in four installments, which are due as follows:

- The 3rd Monday in August

- The 1st Monday in October

- The 1st Monday in January

- The 1st Monday in March

There are penalties for delinquent payments, and the penalties increase significantly for payments made more than 10 days after the due date. Payments can be made through the Clark County Treasurer’s Office.

Will I have to pay property taxes when I purchase my home?

It depends on your situation, particularly the timing of the transaction and whether the seller has paid their tax bill. If they’ve already paid their taxes for the entire fiscal year upon closing, they may require you to reimburse them a prorated amount (from the date of close to the end of the fiscal year). The opposite may also be true. If the seller hasn’t yet paid their taxes upon closing, you may be entitled to a credit—a prorated amount to cover the seller’s share of property taxes for the fiscal year.

On top of property tax, there is another tax due at closing: real property transfer tax (RPTT). In Clark County, this tax comes to $5.10 for every $1,000 of the full purchase price. Customarily, sellers are responsible for paying the transfer tax in resale transactions. Buyers may have to pay half or all of the transfer tax when purchasing new construction.

Do property taxes affect my mortgage payment?

Generally, your monthly payment to your lender will include four things: principal, interest, taxes, and insurance (commonly referred to as PITI). The funds for your property taxes are held in an impound account (also called an escrow account) until taxes are due. At that point, the lender sends payment to the county.

If you have a loan, make sure you understand which payments the lender is impounding each month (taxes, insurance, etc.) and which payments you are responsible for (HOA, Master Association, SID, etc.). This will help you avoid any situation that may place your property at risk of fines for delinquencies.

How are property taxes calculated?

Tax rates vary by tax district and are subject to change every fiscal year, but property taxes in Nevada are always calculated as an ad valorem tax (tax according to value). A property’s taxable value is determined by the Assessor and is defined by Clark County as “the market value of the land and the current replacement cost of improvements less statutory depreciation.”

This is not the same as a home’s resale value, which fluctuates with the market. Quite often, the Assessor’s “Taxable Value” may be quite different from the current prices of similar homes in your neighborhood. While your property tax bill may increase with your home’s value, there is a limit to how much, which you can read more about below.

If you want easy math, a common approximation of your annual property tax bill is 1% of the final sales price. For detailed and timely information about how property taxes are calculated, visit the Clark County Assessor’s website.

How often are properties assessed?

Nevada law requires the County Assessor to assess all property every year. Some buyers worry that the property they’re buying will need to be reassessed when the transaction is complete, thereby increasing their tax bill, but this is not the case. According to Nevada tax attorneys quoted in Mansion Global, “Unlike in nearby California, when a house is sold in Nevada, the sale does not trigger a reassessment of the property for tax purposes.”

What if I disagree with the assessed value?

In mid-December, Clark County sends a notice of value to every homeowner for the upcoming fiscal year. This gives you ample time to discuss your valuation with an appraiser in the Assessor’s Office if you have concerns regarding the taxable value of your property.

If you and the county cannot resolve those concerns, you may file an appeal by January 15th. Call (702) 455-4997 to order an appeal form.

Do property taxes increase over time?

Because homes are assessed yearly, property taxes can go up every year. However, homeowners are protected from steep increases by Nevada’s tax abatement law.

At present, Nevada’s tax abatement law, NRS 361.4723, applies a 3% cap on the tax bill of the homeowner’s primary residence. As Smart Asset puts it, “The law limits increases in property taxes on primary residences to 3% per year. Thus, even if home values increase by 10%, property taxes will increase by no more than 3%.” Additionally, when you buy a home, you inherit the seller’s tax cap for that fiscal year. The following year, your taxes can only increase by another 3%, and so on.

A good example of this can be found by looking at the public tax history for 3040 American River Lane, a property we sold for $2,575,000 in 2021. In 2020, the home’s assessed value was $478,821 (7% higher than the previous year), but the homeowner’s annual property tax bill only increased by 3%—from $8,932 to $9,199. Likewise, in 2021, their property tax bill increased another 3% to $9,476 (less than .4% of the $2,575,000 sales price). The same 3% cap applied to 2022.

The keyword here is primary residence. If you own multiple properties, you can only claim one as your primary residence, and you actually have to live there. Your primary residence can be a single-family house, townhouse, condominium, or manufactured home. The yearly tax increase for all other properties you own, including investment properties, is capped at 8%.

New construction or property that has a change of use (zoning change or manufactured home conversion) does not qualify for any cap the first fiscal year but receives a 3% to 8% cap starting the next fiscal year.

Where can I find more information about property taxes?

For up-to-date information, including tax rates and future deadlines, visit the Clark County Assessor’s website.

At the Rob Jensen Company, we represent buyers and sellers in Clark County every day—particularly in Summerlin, Las Vegas, and Henderson. If you disagree with your home’s assessed value, we would be happy to pull comps for you (that’s real estate lingo for finding comparable sales). Give us a call today at 702-605-7482.